About Us

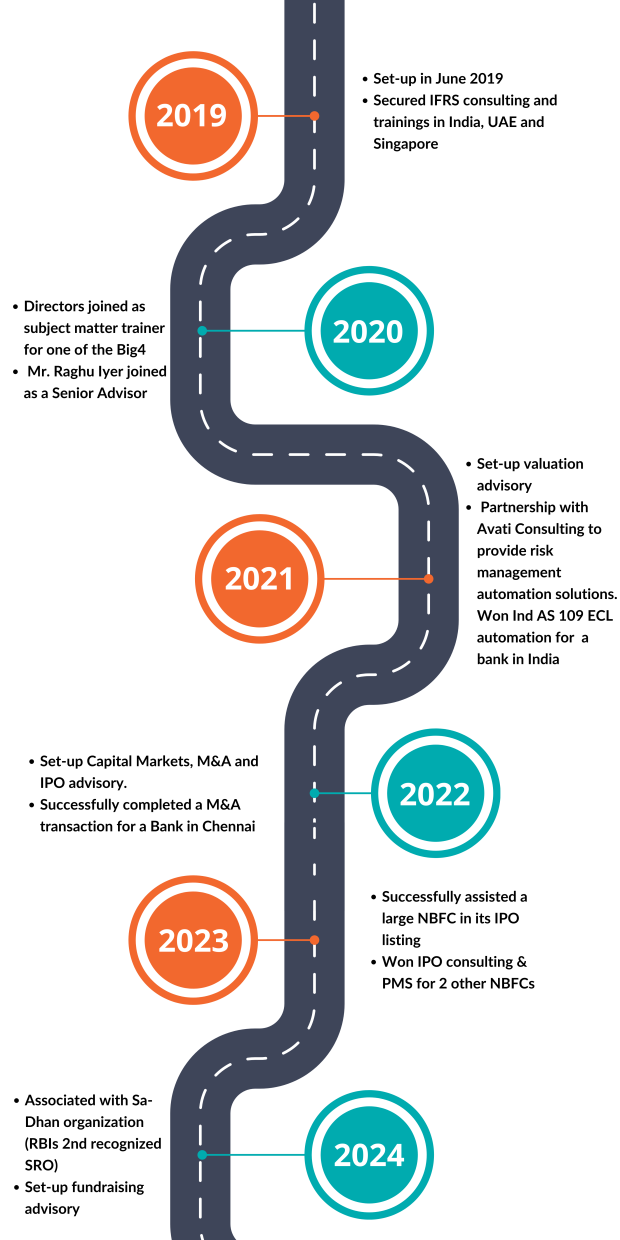

Arham AdvantEdge Private Limited (AAPL) is a management consulting company founded in 2019 by entrepreneurial Chartered Accountants from Big 4 consulting firms with a collaborative vision of building one of the finest professional services company in India.

Our solutions are focused to deliver deep expertise, objective insights, a tailored approach, and unparalleled collaboration to help leaders confidently face the future. Our solutions span across financial & accounting advisory, risk management, transactions including M&A and fund raising advisory, capital markets (IPO) advisory, and technology solutions.

With the business & regulatory landscape evolving rapidly, requiring organizations to adapt continuously, the need of the hour is a focused and agile company that can help organizations navigate through complex issues. With an experienced team of professionals, we aspire to fill this gap and assist organizations unleash their true growth potential.